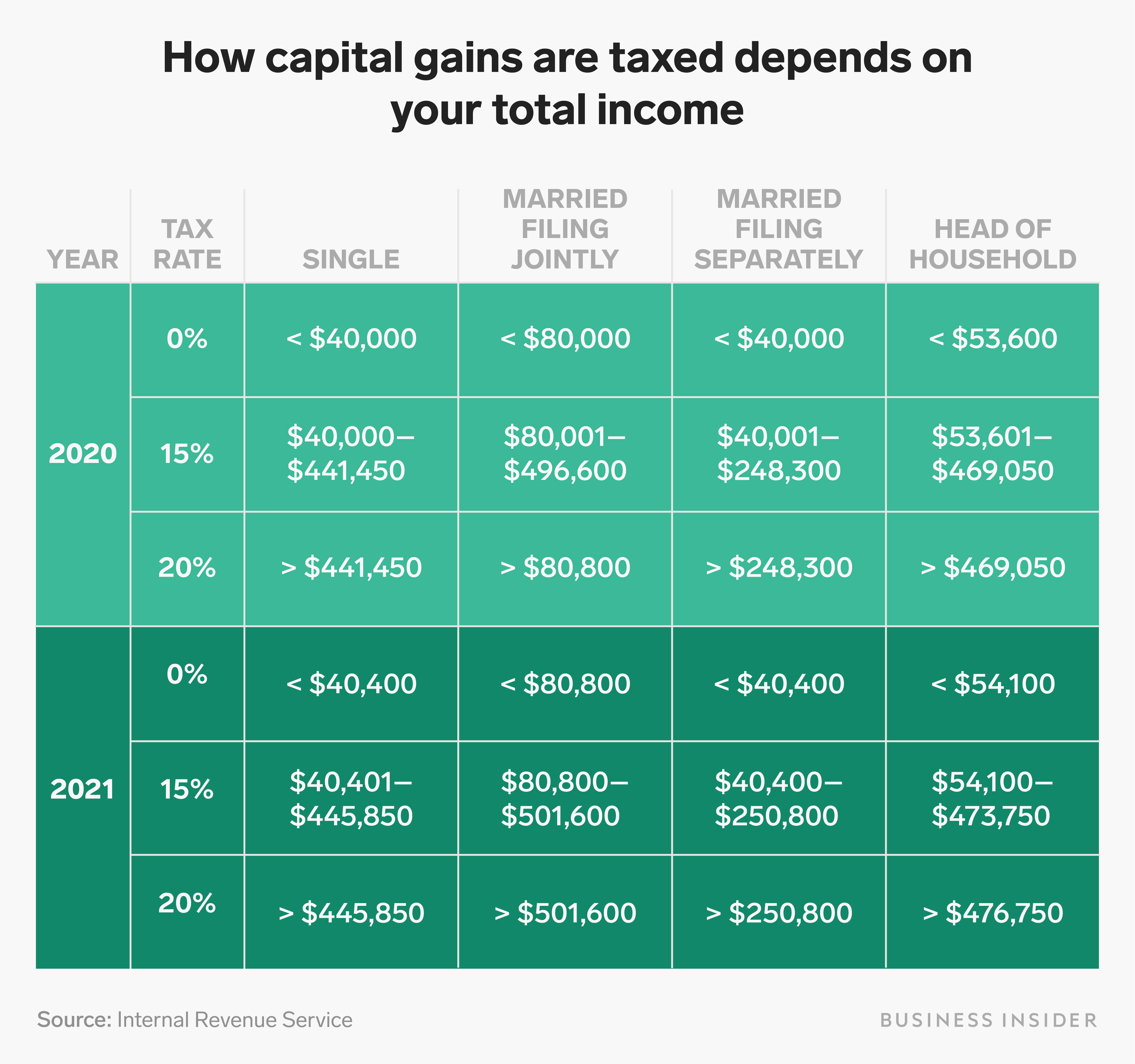

2025 Capital Gain Tax Brackets. When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. Get the information about the old and new income tax slabs for individuals, senior citizens and super senior.

The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been. 10%, 12%, 22%, 24%, 32%, 35% or 37%.

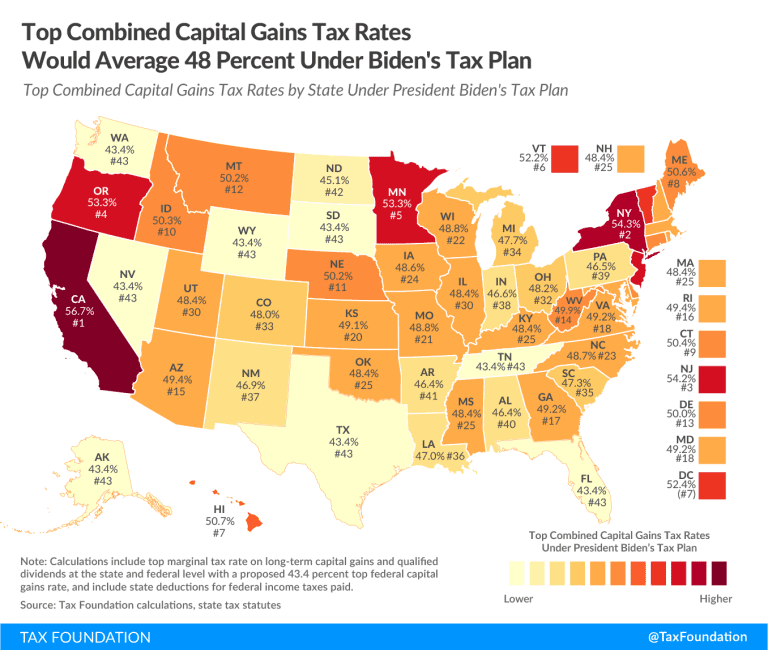

Mapped Biden’s Capital Gain Tax Increase Proposal by State, What is capital gains tax? Get the information about the old and new income tax slabs for individuals, senior citizens and super senior.

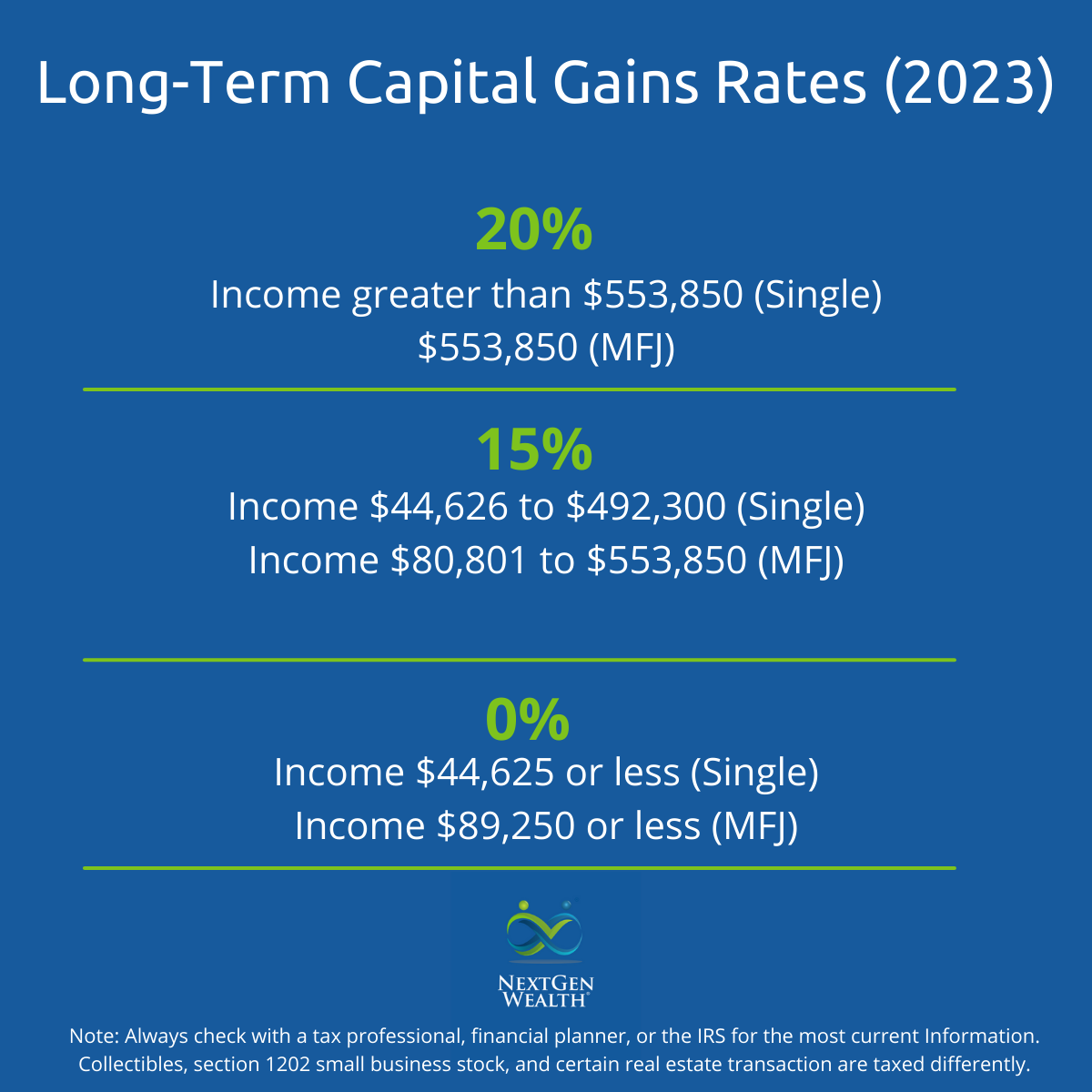

Capital Gains Tax Brackets for Home Sellers What’s Your Rate, What is capital gains tax? Remember, this isn't for the tax return you file in 2025, but rather, any gains you incur.

Capital Gains Tax Brackets Overview YouTube, Tax year 2025 tax rates and brackets. Capital gains tax is the tax you pay after selling an asset that has increased in value.

Can Capital Gains Push Me Into a Higher Tax Bracket?, What is capital gains tax? However, for 2018 through 2025, these rates have their own brackets that are not.

Capital gains tax rates How to calculate them and tips on how to, A review and possible simplification of the capital. When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains.

How Rising Inflation Can Affect Your Federal Tax Bracket Next Year, What is capital gains tax? Updated jul 03, 2025, 2:55 pm ist.

Capital Gains Brackets 2025 Legra Natalee, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. Without getting into the minutiae, there are four main areas we’re concerned with:

T200018 Baseline Distribution of and Federal Taxes, All Tax, What investments are subject to capital. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

Capital Gains Tax Brackets More Complicated Than Evensky & Katz, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been. Identify positions in which you have a capital gain or capital loss.

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan, Capital gains tax is the tax you may have to pay on the profits of investments you've sold in the current tax year. However, for 2018 through 2025, these rates have their own brackets that are not.