Tax Brackets 2025 Head Of Household 1 Dependent. Fact checked by kirsten rohrs schmitt. Married couples filing separately and head of household filers;

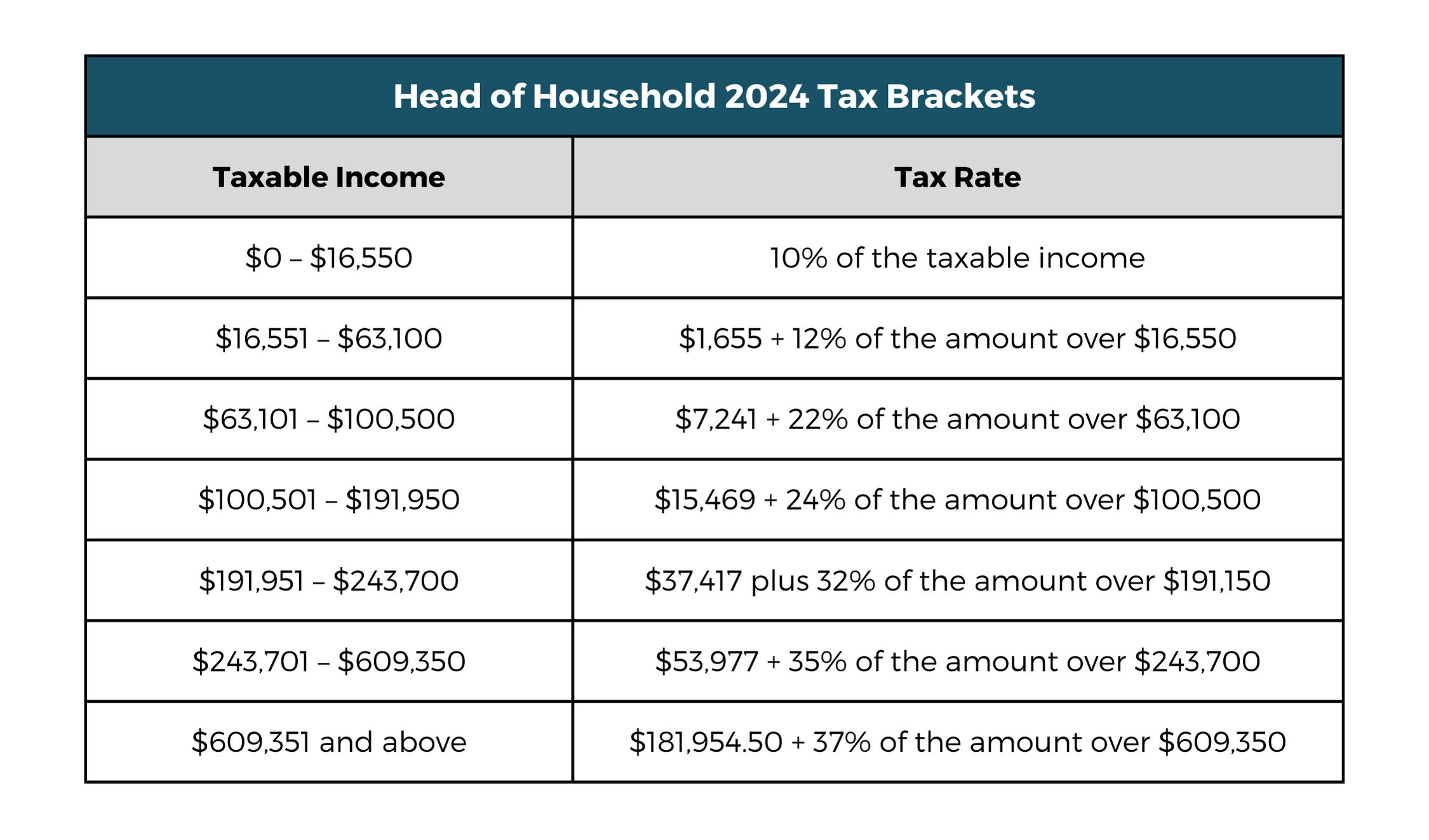

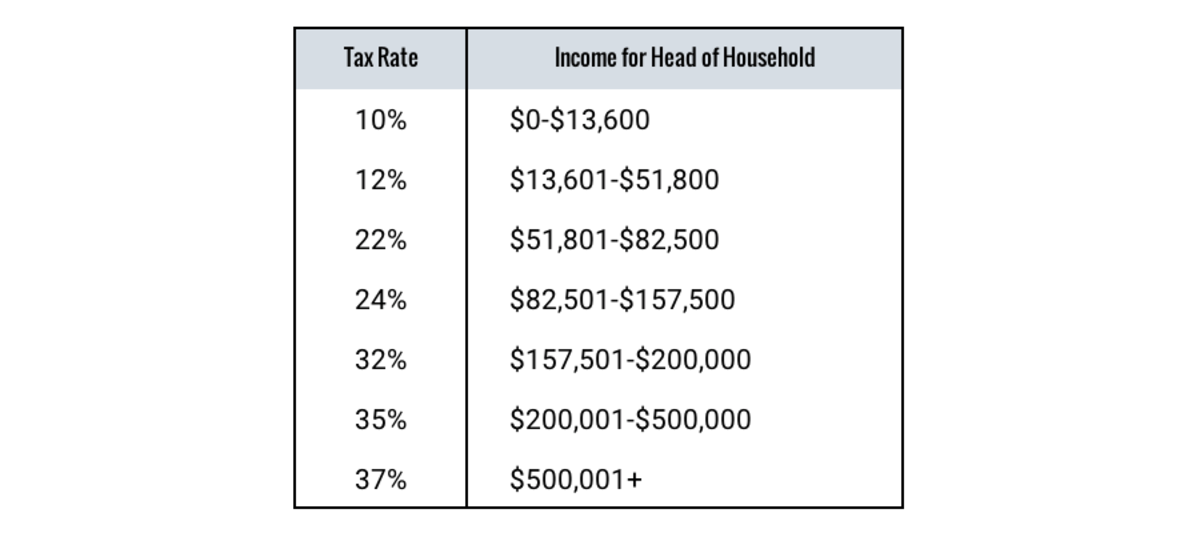

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For example, in tax year 2025 the head of household 12% tax bracket is $63,100 (which is up from $59,850 in 2025) of taxable income compared with just $47,150 for single. Up to $11,600 (was $11,000 for 2025) — 10% more than $11,600 (was $11,000) —.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Estimate your 2025 taxable income (for taxes filed in 2025) with our tax bracket calculator. What are the qualifications to file as head of household?

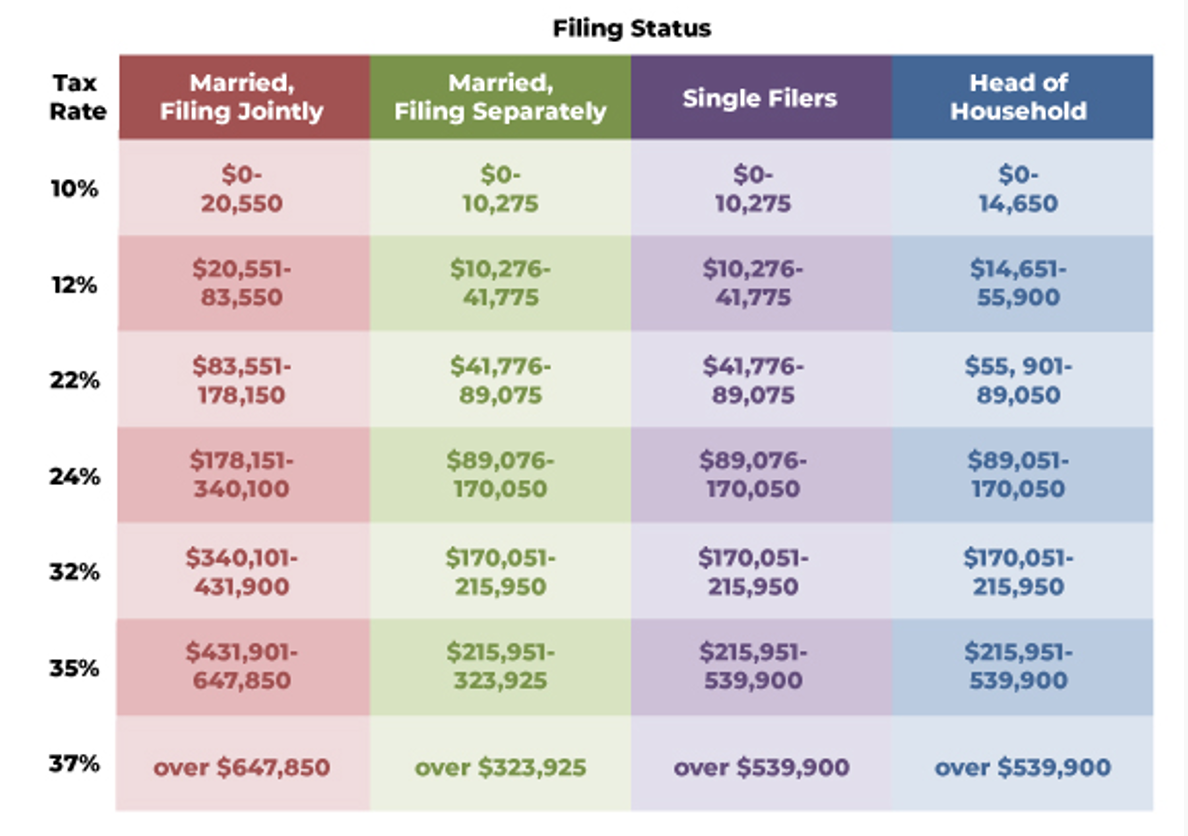

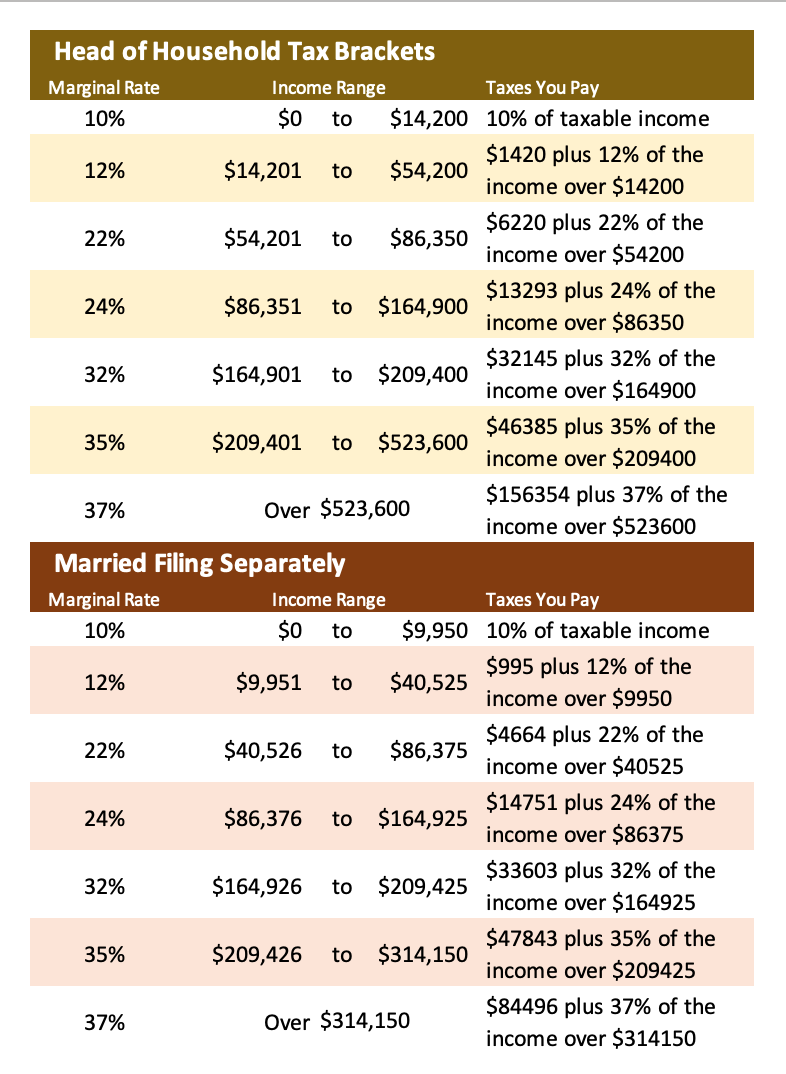

2025 Tax Rates, Standard Deduction Amounts to be prepared in 2025, Taxable income and filing status determine which federal tax rates apply to. You can file as head of household if you are unmarried, divorced, have a qualifying child or dependent and paid more than half the costs of running.

Do I Qualify For Head Of Household Credit Credit Walls, When are you considered unmarried? 2. Single taxpayers 2025 official tax brackets.

Understanding Marginal Tax Brackets Wealth Management Group LLC, Married couples filing separately and head of household filers; How can you qualify for head of household status?

IRS 2025 Tax Tables, Deductions, & Exemptions — purposeful.finance, Who is able to file as a head of household? Fact checked by kirsten rohrs schmitt.

Virginia Tax Brackets 2025 Ardys Winnah, If you make $70,000 a year living in delaware you will be taxed $11,042. Can you claim a dependent on your tax return?

Tax Rates 2025 To 2025 2025 Printable Calendar, Who is able to file as a head of household? As your income goes up, the tax rate on the next layer of income is higher.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the 2025 tax year. In 2025 and 2025, there are seven federal income tax rates and brackets:

Here's how the new US tax brackets for 2019 affect every American, Considered unmarried to qualify for head of household status,. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the 2025 tax year.