Tax Brackets For Self Employed 2025. This percentage includes social security and medicare. January 16 (q4 payment of.

Self employed workers, such as a sole trader, company director, or someone in a partnership, pay income tax or corporation tax through self assessment tax return,. The 2025 standard deduction amounts are as follows:

Irs New Tax Brackets 2025 Elene Hedvige, Want to estimate your tax refund? Changes to reporting income from self employment and partnerships.

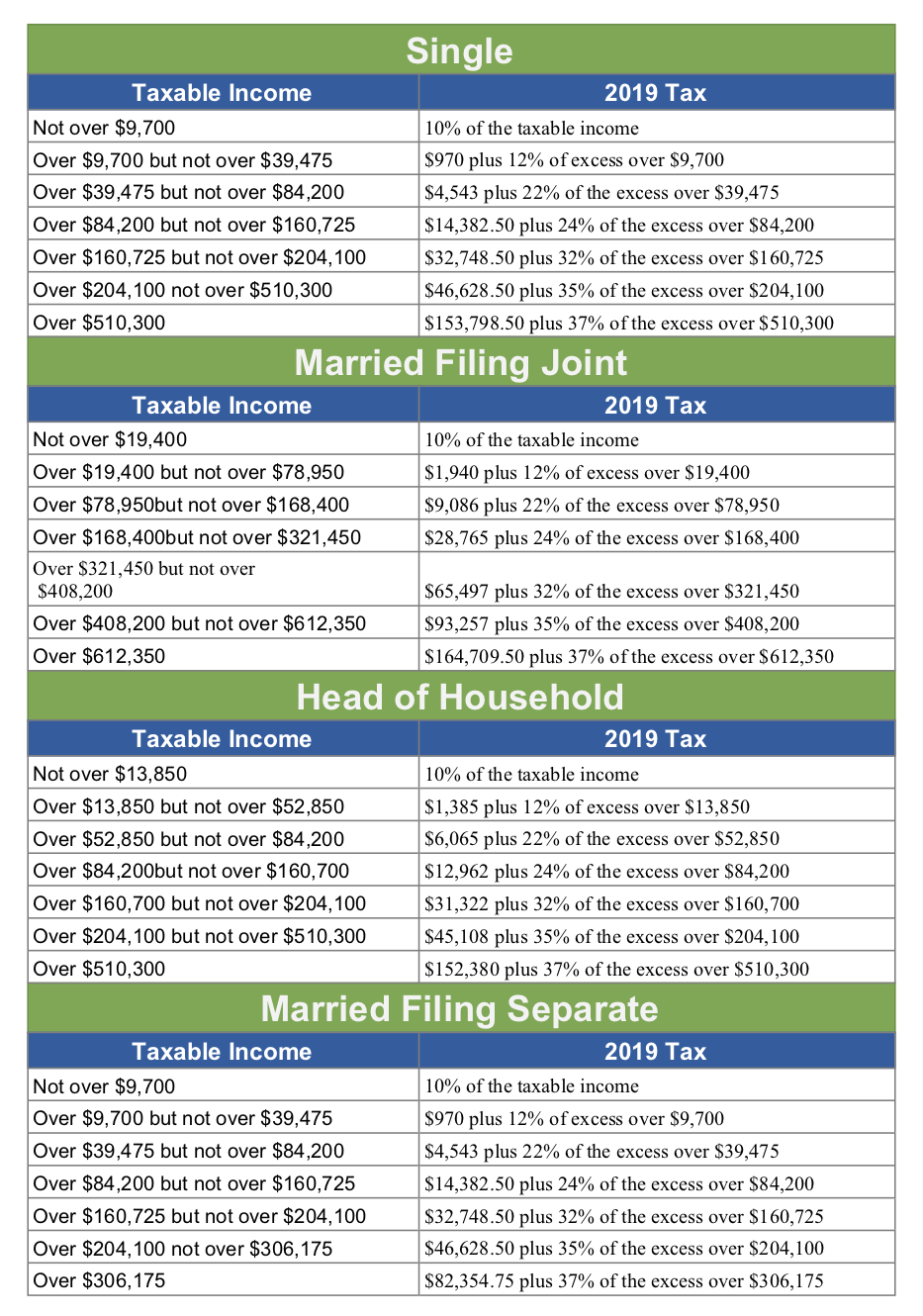

Tax Brackets 2025 What I Need To Know.Gov Milka Suzanna, These rates apply to your taxable. Tax brackets and tax rates.

Tax rates for the 2025 year of assessment Just One Lap, How much income tax you pay in each tax year depends on: Previous year income tax rates.

Tax Brackets 2025 Irs Single Elana Harmony, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). There are usually new uk tax brackets and other updates to thresholds introduced each april.

Tax Brackets for 20232024 & Federal Tax Rates (2025), Single or married filing separately: Want to estimate your tax refund?

Understanding selfemployment taxes as a freelancer Tax Queen, Single or married filing separately: If you want to know your marginal tax bracket for the 2025 tax year, use our calculator.

A Beginner's Guide for SelfEmployment Tax TaxSlayer®, There are seven (7) tax rates in 2025. January 16 (q4 payment of.

Tax Brackets 2025 Table Pdf Tandi Florella, Simply enter your taxable income and filing status to find your top tax rate. Page last reviewed or updated:

Self Employment Tax Tips For 2025 What You Need To Know YouTube, Tax bracket for self employed 2025. 2025 federal income tax rates.